You must close your tax accounts, which may include filing a final sales tax return and canceling your vendor’s license.

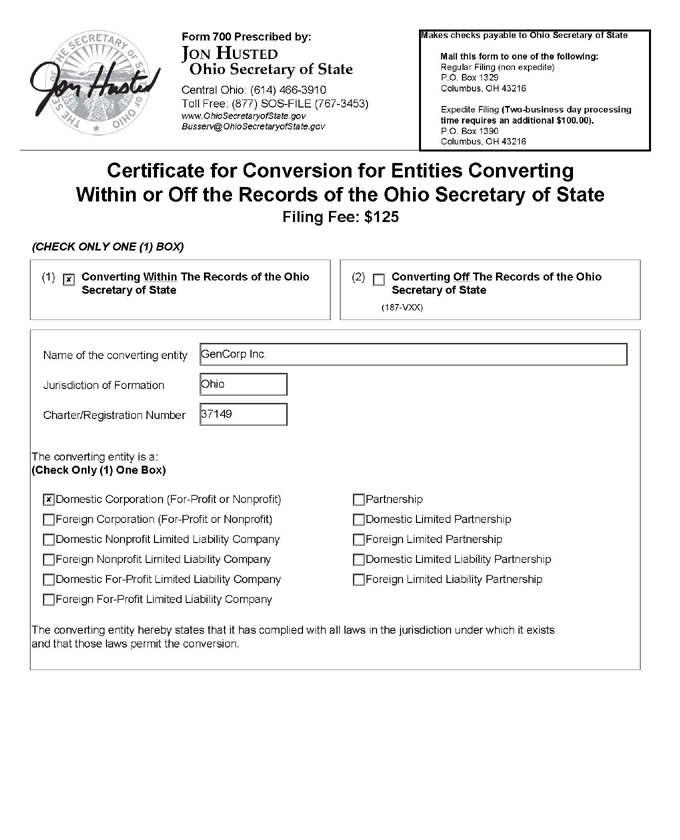

See below for information on closing common business filings. You’ll need to close/cancel all business accounts you have with state, as well as cancel any licenses. File a Dissolutionĭepending on your business’ legal entity, you may need to file a dissolution with the Secretary of State. There may be more to do at federal and local levels. These links go directly to the official business entity search page within each state department.īelow are all 50 states’ business entity search & corporate record search pages, as well as the District of Columbia and Puerto Rico.To close your business at the state-level of government, you may need to file a dissolution with the Secretary of State as well as close any business accounts you have with the state. If you’re looking to search business entities, such as LLCs, Corporations, LPs, LLPs, etc., then all the links you need are in the 3rd column below. Business Entity and Corporate Record Search (3rd column) Please see best state to form an LLC for more information. Tip: It’s best to form an LLC in the state where you doing business. These business services divisions are responsible for the formations, amendments, dissolutions, and record keeping of all business entities registered and authorized to do business in the state. This is usually a sub-department under the Secretary of State, Department of State, Commonwealth, etc.

Corporation/Business Division (2nd column) This is the main governing body of a state, usually called the Secretary of State, but may have a different name (ex: Department of State, Commonwealth, or simply, The State of…”). Links to all 50 States: Secretary of State (SOS) Website, Business/Corporate Services Division, and Business Entity Searches The table below is up to date as of 2023.

0 kommentar(er)

0 kommentar(er)